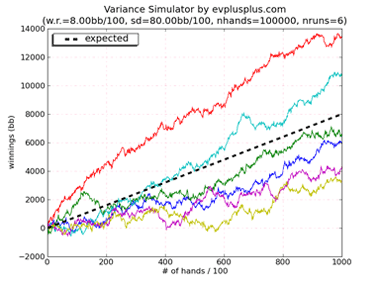

Take a look at this variance simulator for a winning poker player:

It's the same with investing. You make your picks, the average of them would be an EV (expected value) and what actually happens will be any one of those lines.

The problem with doing what you're saying is that you have to make so many trades over such a long period of time to

prove you're better than the market, rather than lucky.

Most investors ride on a lucky wave, get over confident, make poor choices and lose a ton of money when the markets crash, etc.

Individual stocks can move up 30% just as easily as they can drop 30%. Institutional investors have all the same information you have, and desks full of people that know a lot more about these companies than you do. If a stock is sure to go up 30%, that'll be factored into the price.

It's non-sensical to assume in most cases you know something that all these huge market moving institutions don't. By the nature of this, any "insight" you have is dependent on luck. The problem is you'll get lucky and get winners, and think you know something, or made "good buys". You could invest in 5 stocks that each go up 100% this year, all on the back of luck alone.

Amazon lost 90% of its value in the year 2000.

Even stocks like Apple lost ~half their value in 2008.

Most investors are just gambling. They get a rush from spending all that time picking the perfect stop, and seeing it fly up 30% over the year. The only difference is that in the casino the odds are stacked against you, in the markets, they generally trend up year-on-year.